Cost Analysis of Custom Printed Bamboo Pajamas

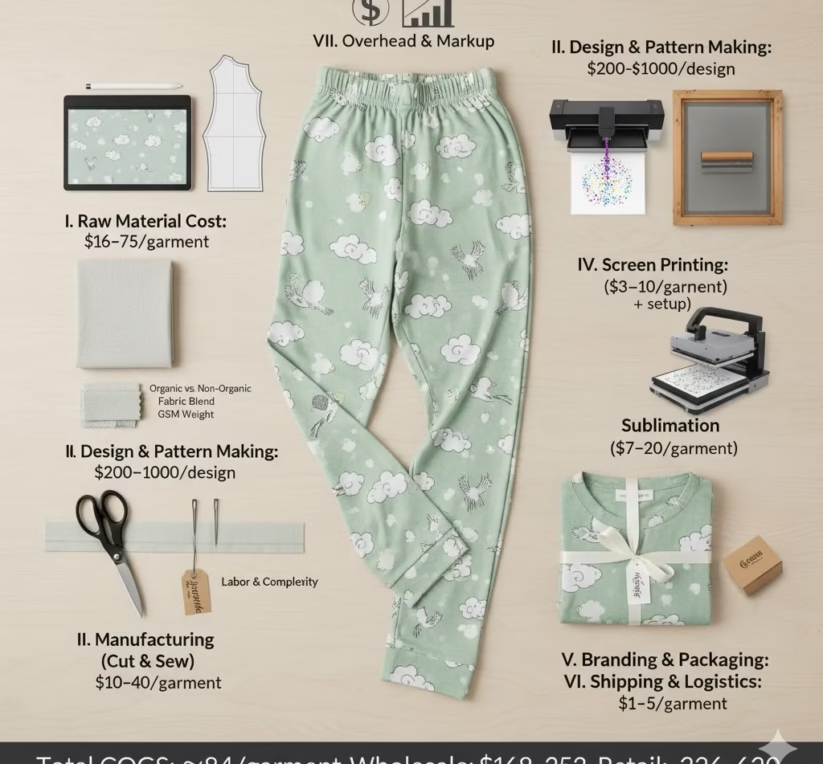

I. The True Cost Formula: Landed Cost

Conteúdo

The core of the article must introduce the “Landed Cost” formula, which is the only way to accurately calculate profitability.

II. Tier 1: Manufacturing Cost (The Factory Quote)

This is the price per unit quoted by the manufacturer, which is comprised of several key variable factors.

| Cost Component | Key Factors Influencing Price | Typical Range (Per Unit) |

|---|---|---|

| 1. Raw Material (Bamboo Viscose) | Quality/Certification: GOTS certified organic bamboo is typically higher than standard bamboo viscose. | ~$2 – $4 |

| 2. Cut & Sew Labor | Complexity: Zippers, footies, fold-over mittens, and ruffles increase labor hours and cost. | ~$3 – $6 |

| 3. Printing Method (Custom) | Digital vs. Screen Printing: Digital printing is better for low MOQs and complex designs but more expensive per piece. | ~$1 – $3 |

| 4. Minimum Order Quantity (MOQ) | Volume: Higher volume orders (e.g., 1000+ units) significantly lower the per-unit cost. | ~$8 – $15 (Low MOQ) |

| 5. Trims & Accessories | Quality: YKK zippers (premium), custom woven size tags, and branded care labels. | ~$0.50 – $1.50 |

III. Tier 2: Logistics Costs (The Hidden Fees)

These costs are often overlooked by new brands and can destroy margins if not accounted for.

-

Freight: Shipping from the factory (e.g., China, Vietnam) to your warehouse (e.g., USA). The method dictates the cost:

-

Air Freight (Expensive/Fast): Used for samples or rush orders.

-

Sea Freight (Cheap/Slow): Best for bulk production runs.

-

-

Customs Brokerage Fees: Fees paid to a third party to handle the paperwork, duties, and customs clearance.

-

Drayage/Local Delivery: The cost to move the container from the port to your final warehouse or 3PL (Third-Party Logistics) center.

-

Insurance: Protecting your shipment against loss or damage during transit (Incoterms like FOB or CIF determine who pays).

IV. Tier 3: Duties and Taxes

This is one of the most unpredictable areas for apparel, especially bamboo.

-

Tariffs/Import Duties: Calculated based on the product’s HS Code (Harmonized System Code) and the country of origin. Tariffs on certain apparel can be very high (e.g., in the 15-25%+ range).

-

Tariff Calculation Example: If a manufacturer charges 10$ for the pajamas, and the tariff rate is 16%, the duty is 1.60$ per unit.

-

Value Added Tax (VAT) / Goods and Services Tax (GST): Applicable if importing to regions like Europe, Canada, or Australia.

V. Tier 4: Pro-Rated Overhead

These are one-time or fixed costs that must be spread across all units produced.

-

Sampling: The cost of the initial proto-sample, fit sample, and production sample (e.g., 3 x$40 per sample).

-

Pattern Grading: The cost of creating patterns for all sizes (e.g., 0-3M up to 5T).

-

Compliance Testing (CPSIA): Mandatory testing for flammability, lead, and small parts for children’s sleepwear. This is a large, fixed cost (often $500 – $2,000+ per style/fabric/color batch) that must be added to your total Landed Cost.

VI. Conclusion & Profitability Checklist

-

The 3-5x Markup Rule: Once you have your accurate Landed Cost per Unit, you should typically multiply it by a factor of 3 to 5 to arrive at your competitive Retail Price (e.g., Landed Cost of $18 x 4 = $72Retail Price).

-

Profitability Check: Remind the reader that the retail price must cover Landed Cost, Marketing (Ads), and Operational expenses.

Sobre o autor

Xhiney, fundadora da Petelulu, tem mais de 20 anos de experiência em design, produção e comércio internacional de vestuário para crianças. Colaboradora da Roupa de criança e Júnior Xhiney passou 17 anos a trabalhar com marcas de roupa de criança de gama alta na Europa e nos EUA, oferecendo conhecimentos especializados e apoio.